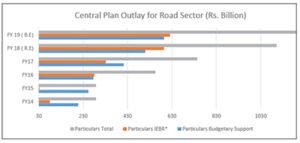

Infrastructure acts as the catalyst to economic growth and the current government has been addressing the bottlenecks that impede growth in the sector. We have observed the continued support from the government in terms of higher budgetary allocation towards infrastructure sector to revive the investment cycle. This year, we have witnessed all time high allocation; the rail and road sectors expecting investments to the tune of Rs 1.48 trillion and Rs 1.21 trillion respectively of the total outlay of Rs 5.97 trillion. The higher budgetary allocation will complement the targeted construction of 41km/ day corresponding to average highway construction of 27km/day at present.

Infrastructure acts as the catalyst to economic growth and the current government has been addressing the bottlenecks that impede growth in the sector. We have observed the continued support from the government in terms of higher budgetary allocation towards infrastructure sector to revive the investment cycle. This year, we have witnessed all time high allocation; the rail and road sectors expecting investments to the tune of Rs 1.48 trillion and Rs 1.21 trillion respectively of the total outlay of Rs 5.97 trillion. The higher budgetary allocation will complement the targeted construction of 41km/ day corresponding to average highway construction of 27km/day at present.

Finance minister’s budget speech emphasized on developing connectivity infrastructure in boarder areas through construction of tunnels, Zojila Pass tunnel being one them. IL&FS Transportation Networks Limited has signed the contract agreement with NHIDCL, the preliminary preparatory works are in progress for constructing 14km, Rs 4899Cr Zojila pass tunnel that will connected Srinagar, Kargil and Leh.

In the case of road sector, as expected, emphasis was on the current proposals instead of new big bang projects. Government intends to drive the Bharatmala Pariyojana, the program for the highway sector that focuses on improving the passenger and freight movement by bridging critical infrastructure gaps through effective interventions for enhanced connectivity of interior and backward areas and borders of the country to develop about 35000kms in Phase-I at an estimated cost of Rs 5,35,000Cr. This program is likely to re-define road development in India as well have a macro approach while planning the expansion of national highways network. It will play a positive role in promoting economic growth, poverty reduction, rural job creation and enhance the livelihoods and livability of the citizens in the respective regions.

In the case of road sector, as expected, emphasis was on the current proposals instead of new big bang projects. Government intends to drive the Bharatmala Pariyojana, the program for the highway sector that focuses on improving the passenger and freight movement by bridging critical infrastructure gaps through effective interventions for enhanced connectivity of interior and backward areas and borders of the country to develop about 35000kms in Phase-I at an estimated cost of Rs 5,35,000Cr. This program is likely to re-define road development in India as well have a macro approach while planning the expansion of national highways network. It will play a positive role in promoting economic growth, poverty reduction, rural job creation and enhance the livelihoods and livability of the citizens in the respective regions.

The enhanced budgetary allocation towards Pradhan Mantri Gram Sadak Yojana (PMGSY) will also push the rural infrastructure by connecting markets. In terms of per day construction, in the rural areas we have achieved 130km per day during FY 17 corresponding to 100km per day in FY15. We anticipate PMSGSY to provide all weather road connectivity to unconnected villages in India by 2019.

To enhance the liquidity from the market, the measures proposed to raise equity for the matured brownfield assets is by using Toll-Operate-Transfer model and Infrastructure Investment Funds (InvITs). Asset recycling model has been successful across the world in various infrastructure projects; it’s a process whereby the government, without transferring its ownership in operational infrastructure/ road projects will allow the private sector to undertake the long term Operations & Maintenance obligations on payment of a lump sum concession fees.

From NHAI’s perspective, this could be an effective use of capital to initialize various road projects. The quicker the pace, the more effective the process in terms of usage of Government’s capital. We have seen a lot of interest from Sovereign Wealth funds, Institutional investors, pension and Insurance funds towards this model as the corresponding risks towards operating and maintaining a road project is significantly lower than constructing a brownfield or a greenfield road project.

NHAI could also use Infrastructure investment trusts (InvITs) to raise capital to fund its projects. InvITs offer multiple benefits to NHAI as well as infrastructure developers. Basically it supports in unlocking the invested capital from the completed projects to deleverage the holding company and even bid for new projects and complete the cost overruns. For an investor, the key factor in arriving at the fair market value of these assets would be the underlying ability of the asset to generate cash flows and not the value at which the existing owner has acquired or built it and carried forward in books of accounts. Considering the foregoing, Discounted Cash Flow (DCF) methodology is therefore an appropriate valuation approach for investors in infrastructure assets.

The Central Board of Direct Taxes (CBDT) has published rules for Sections 50CA and 56(2)(x) of the Income Tax Act, to substitute existing rules as set out in Rule 11UA of the Income Tax Rules, 1962 for computing Fair Market value of unquoted equity shares. Application of Book Value as the Fair Market Value (except in case of certain assets) leads to severe tax consequences if the Fair Market Value based on DCF approach is lower.

It is suggested that the Rules may appropriately be amended to prescribe DCF method of computing Fair Market Value in case of transfer of infrastructure assets where a carve out can be made under the provisions discussed above for transfer of assets effected under the InvIT framework as approved by SEBI, and schemes to resolve stressed assets administered by RBI and NCLT.

It is suggested that the Rules may appropriately be amended to prescribe DCF method of computing Fair Market Value in case of transfer of infrastructure assets where a carve out can be made under the provisions discussed above for transfer of assets effected under the InvIT framework as approved by SEBI, and schemes to resolve stressed assets administered by RBI and NCLT.

The finance minister’s suggestions regarding corporate bonds and investment grades are steps in the right directions. “It is now time to move from ‘AA’ to ‘A’ grade ratings. The government and concerned regulators will take necessary action”. This will definitely help the development of corporate bond market and the infrastructure developers, especially when infrastructure financing is suffering the twin balance sheet problems. The corporates could tap funds for infrastructure development through capital markets and gain access to institutional investors.

Union Finance Minister Arun Jaitley had maintained a steady focus on PPP in his maiden Budget for 2014-15, announcing a number of steps to fast-track such projects in several areas. However, this year, we haven’t observed any guidance towards PPP model. Kelkar Committee has clearly mentioned that PPPs in infrastructure represent a valuable instrument to speed up infrastructure development in India. We have many success stories in the PPP model on the Highway development. A clear and positive signal is a pre- requisite to encourage the private sector participation and tap into the large pool of pension and institutional funds from the international markets towards the road sector.

TrafficInfraTech Magazine Linking People Places & Progress

TrafficInfraTech Magazine Linking People Places & Progress